Do You Own Australian Property? You Could Save Thousands if You Learn About This One Thing…

Owning property is a great investment, but when it’s time to sell, Capital Gains Tax (CGT) could take a massive chunk of your profits. With the right strategy, you can legally reduce your tax bill and keep more of your profits.

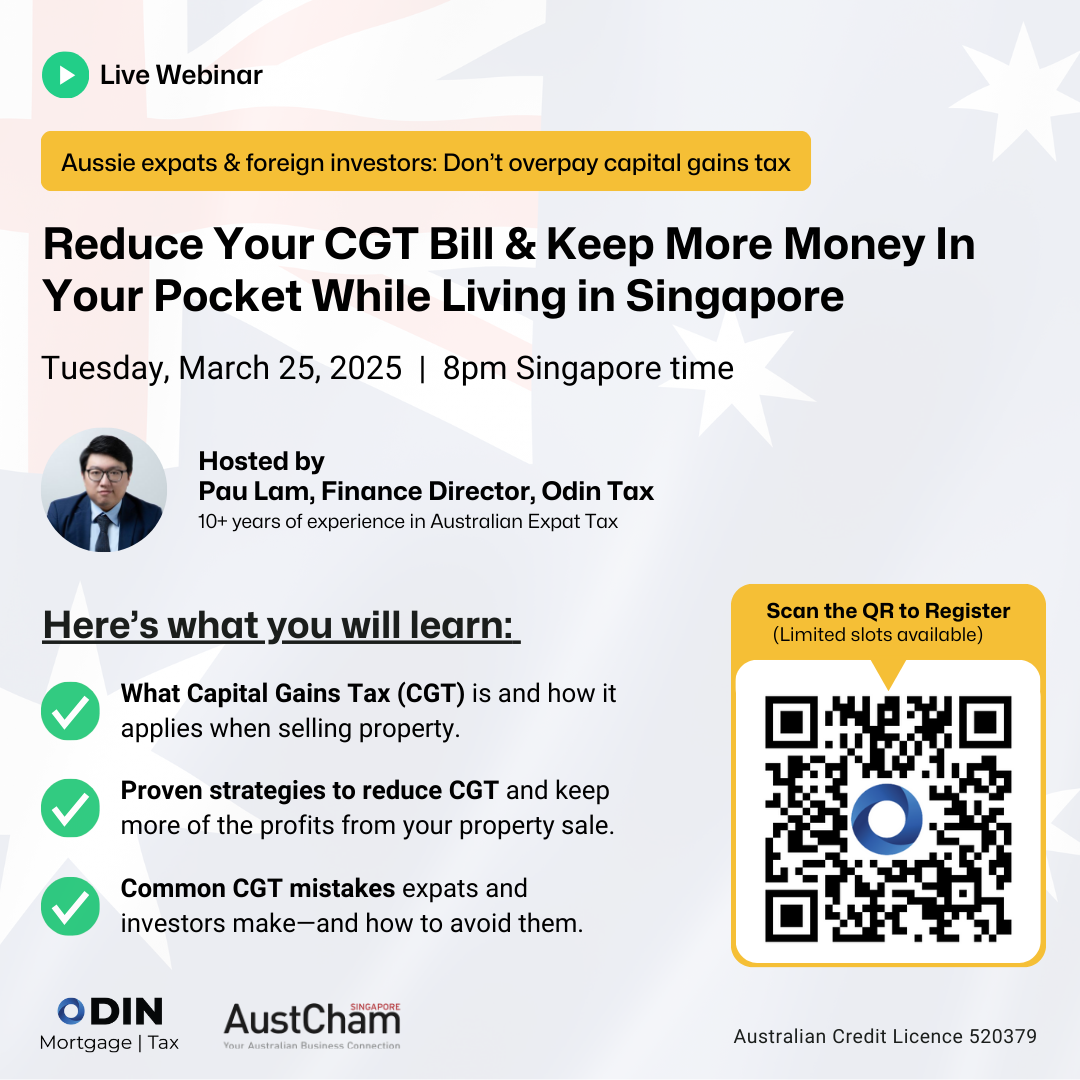

That’s why Odin Mortgage is hosting this free webinar – to show you how to navigate CGT like a pro and keep more profit in your pocket.

The host, Pau has helped expats and investors from Singapore, Hong Kong, the UAE, the US, and the UK slash their CGT liability and structure their finances correctly – so they’re not caught off guard when it’s time to sell.

Here’s what you’ll discover on the webinar:

- What Capital Gains Tax (CGT) is and how it applies when selling property.

- How your tax residency status impacts CGT and whether you qualify for exemptions or discounts.

- Common CGT mistakes expats and investors make—and how to avoid them.

Proven strategies to reduce CGT and keep more of the profits from your property sale.

💬 PLUS: A live Q&A—get expert answers to your specific situation.

When is it happening?

📅 Date: Tuesday, March 25, 2025

⏰ Time: 8:00 PM Singapore time

If you’re thinking about selling now or in the future, this is the info you can’t afford to miss.

Secure your spot now before it’s too late 👉 https://hubs.ly/Q03c1w380

(𝘰𝘯𝘭𝘺 𝘭𝘪𝘮𝘪𝘵𝘦𝘥 𝘴𝘦𝘢𝘵𝘴 𝘳𝘦𝘮𝘢𝘪𝘯𝘪𝘯𝘨)